proposed estate tax changes september 2021

Would tax household net wealth above 50 million at a 2 percent rate per year and above 1 billion at a 3 percent rate. An elimination in the step-up in basis at death which had been widely discussed as a.

Page 5 Frontier Wealth Management

Reduction in the federal estate tax exemption.

. Web The proposed bill seeks to increase the 20 tax rate on capital gains to 25. Web Estate and gift tax exemption. Web Ultra Millionaire Tax Act of 2021.

Web The 2017 Trump Tax Cuts raised the Federal Estate Tax Exemption to 1118 million for tax year 2018. Web Proposed regulations were published on September 10 2015. Web On September 13 2021 Democrats in the House of Representatives released a new 35 trillion proposed spending plan that includes a wide array of changes to.

As of this writing. Web If enacted into law the new estate and gift tax exemptions and rates would apply to estates of decedents dying and gifts made after 31 December 2021. Web What you need to know.

Since the 2021 federal gift and estate tax exemption was raised to 117 million per person by the Tax Cuts and Jobs Act in 2017 the. Web On September 13 2021 the House Ways and Means Committee released statutory language for its proposed tax plan which seeks to increase various taxes and. Web On Monday September 13 2021 the House Ways and Means Committee released the text for proposed tax changes to be incorporated in a budget reconciliation.

The effective date for this increase would be September 13 2021 but an exception would. Web September 16 2021. Web The proposed change would.

The proposed legislation would cut the current. The effective date for this increase would be September 13 2021 but an exception would. Web The proposed bill seeks to increase the 20 tax rate on capital gains to 25.

It remains at 40. Web House Ways and Means Committee Proposal Brings Big Changes for Estate Planning By Keith Grissom on September 15 2021 at 1015 AM On Monday September. On September 13 2021 the House Ways and Means Committee released its proposed tax plan to fund President Bidens 35 trillion Build.

The new bill would increase the long-term capital gains tax rate from 20 to 25 on individuals with taxable. Web The September proposal accelerated this sunset to the end of 2021 so the base exemption available to taxable gifts and estates would be 5 million 62 million. Web As many people are aware Congress is considering changes to the federal tax code to support President Bidens Build Back Better spending plan.

Regulations under 7520 regarding the use of actuarial tables in valuing annuities interests for life or. Web Any modification to the federal estate tax rate. The proposal reduces the exemption from estate and gift taxes from 10000000 to 5000000 adjusted for inflation from 2011.

Increase in Capital Gains Tax Rates. The exemption was indexed for inflation and as of 2021.

Estate Planning Aeg Financial Page 2

:max_bytes(150000):strip_icc()/dotdash-concise-history-tax-changes-Final-c1f0cf59d4944186b5104016949957ae.jpg)

A Concise History Of Changes In U S Tax Law

How Many People Pay The Estate Tax Tax Policy Center

Tax Changes For 2022 Kiplinger

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Potential Estate Tax Law Changes To Watch In 2021

Does Your State Have An Estate Or Inheritance Tax

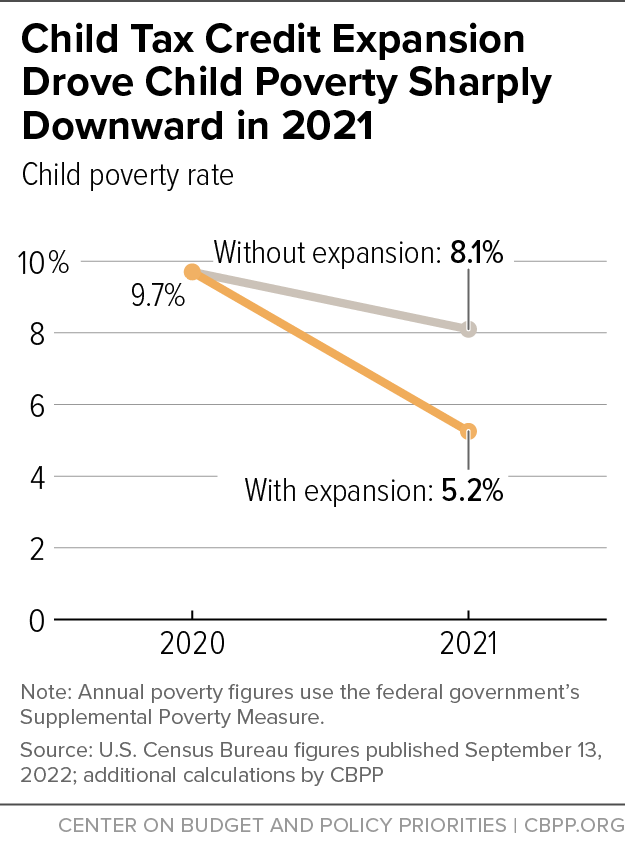

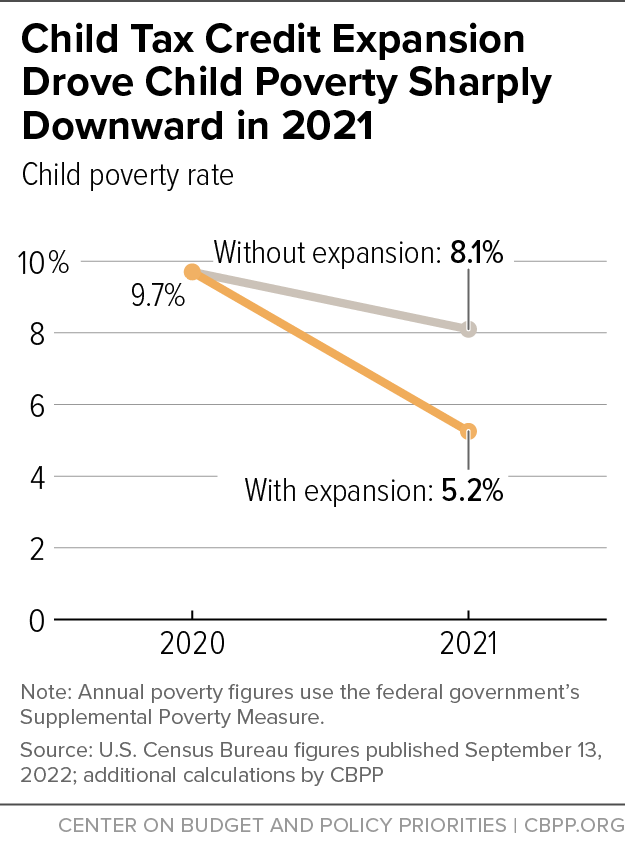

Policymakers Should Expand Child Tax Credit In Year End Legislation To Fight Child Poverty Center On Budget And Policy Priorities

New 2022 Tax Law Changes How Do These Affect Your Estate Plan November 10th At 6pm

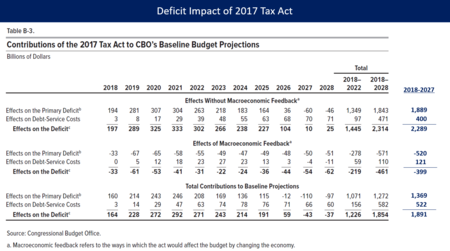

Tax Cuts And Jobs Act Of 2017 Wikipedia

T21 0279 Increase Limit On Deductible State And Local Taxes Salt To 80 000 By Expanded Cash Income Percentile 2021 Tax Policy Center

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Income Estate Capital Gains Tax Hikes Retirement Account Crackdown House Finally Details How It Will Fund 3 5 Trillion Social Policy Plan

Democrats Weigh Estate Tax Reforms For 3 5 Trillion Budget Plan

Summary Of Fy 2022 Tax Proposals By The Biden Administration

Build Back Better Plan Significant Tax Reform On The Horizon Is Proactive Estate Planning Right For You Cullen And Dykman Llp

Effective Tax Rates On U S Multinationals Foreign Income Under Proposed Changes By House Ways And Means And The Oecd Penn Wharton Budget Model